by Edward Hugh: Barcelona

The International Monetary Fund this week forecast the recession in Bulgaria would be deeper than it previously predicted. Such a decision should come as no surprise to anyone, since the country's economic dynamics in both the short and long term look extremely unstable, and Bulgaria is now almost certainly headed towards a series of more or less hair-raising roller-coaster rides. Even the briefest of glances at the population chart above should lead all but the most sceptical among us to stop and think a little about the possible economic implications of such an appauling demographic outlook. As can be seen, the opening to the west brought a sharp outflow of people in the late 1980s (mainly ethnic Turks), but the important thing to note is that the decline has continued almost continuously ever since. That is, the decline was not a one-off demographic "shock", but rather it has become a way of life (or, if you prefer, of death, since deaths constantly outnumber births, even before you consider emigration). And it is this "terminal style" dynamic which virtually guarantess that the coming ride will be a bumpy one, not only in the short term (guaranteed by the size of the current account deficit - 25% - which Bulgaria needs to correct) but in the longer term, since according to any known growth theory there is simply no way any country can sustain headline GDP expansion with potential labour force and population contractions of this magnitude.

Sharp Recession in 2009

Well, to come down to earth with a bump, let's now get into the immediate situation, and return to the fact that the IMF now expects Bulgaria’s economy to shrink by 7 percent in 2009 (previously they were forecasting a 3.5 percent contraction). They also upped (or downed) their 2010 outlook to an anticipated 2.5 percent contraction, from an earlier 1 percent one, although such an adjustment at this point this is now better than mere guesswork. The point is we are in for a severe contraction, and it isn't going to be any laughing matter.

The IMF revision also follows last weeks announcement that it now expects a “sluggish” global economic recovery and its 2009 forecast reduction for central and eastern European, which went to a 5 percent contraction from an earlier 3.7 percent one.

The heart of the Bulgarian problem at the moment stems from the need to correct a current account deficit which reached 25pc of GDP in 2008, the highest of the 80 emerging markets around the world tracked by Fitch Ratings. Gross external debt reached 102 percent of GDP.

Bulgaria faces a drastic process of external adjustment process which with the shadow of the current international economic crisis hanging over it will surely be far from painless. Vulnerabilities accumulated during the boom period - a marked rise in private sector external, debt along with a rapid increase in credit growth and widespread FX-denominated borrowing - will make demonstrating unwavering commitment to the currency board arrangement very hard work indeed. Neil Shearing at Capital Economics estimates Bulgaria’s external financing needs at $25 billion this year, including the current-account deficit, short-term private foreign debt payments and interest payments. Foreign investment has fallen by almost half over the last year. Meanwhile private debt is up to just shy of 100 percent of gross domestic product, while the government budget revenue fell 6 percent in May.

Plummeting GDP

The Bulgarian economy contracted 3.5 percent in the first quarter when compared with the first quarter of 2008, according to the most recent figures from the National Statistics Office. The turnround is massive when you consider that the economy actually grew by 3.5 percent year on year in the last three months of 2008. In fact, GDP actually shrank by 5 percent from the fourth quarter (or at an annual 20% rate), when it contracted 1.6 percent, according to quarterly data which the statistics institute published for the first time (although these are not seasonally adjusted, so we need to be careful in drawing conclusions). At this speed, I would say even the IMF estimate may well fall significantly short of the final outcome, and we could well be looking at a double digit contraction in 2009. Basically make this kind of current account correction without any sort of currency adjustment is extremely costly in short term GDP, as we are seeing in the Baltics.

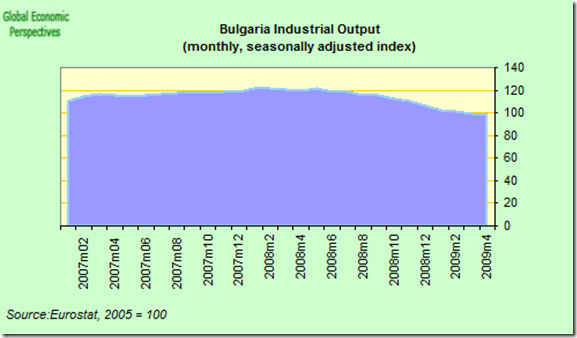

Domestic consumption fell 5.4 percent in the first quarter from a year earlier after a 1.4 percent increase in the previous three months. Industrial output, which makes up 31 percent of total GDP, plummeted an annual 12.4 percent in the first quarter, after a 3.7 percent decline in the fourth quarter of 2009. Agricultural output, which accounts for 4 percent of the economy, dropped 4 percent after rising 26.7 percent in the fourth quarter. Services, which make up 65 percent of GDP, rose an annual 2.5 percent after a 3.8 percent gain in the previous quarter, although it is obvious that on a quarter over quarter basis even services are now contracting.

First-quarter exports dropped 17.4 percent, while imports dropped 21 percent, meaning that the net trade impact on GDP was positive.

Short Term Indicators

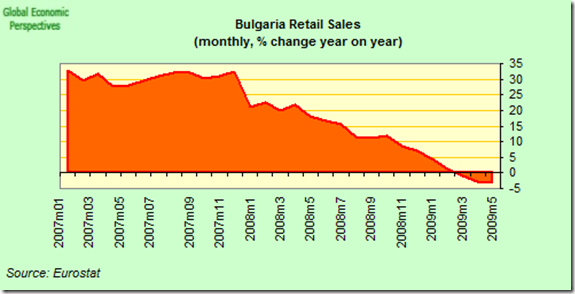

Bulgarian industrial production continues to fall and was 22.1 percent from a year earlier in May - the eighth consecutive monthly decline. Output was also down month on month - by 1 percent over April. Retail sales dropped an annual 10.4 percent in May.

Construction activity is also well down, falling by 9 percent in April, over April 2008 according to Eurostat data.

Domestic demand is in full retreat, as evidenced by retail sales which were down by 3% year on year in May, with the pace of decline steadily increasing.

Unemployment is also rising, and hit 6.5% in May, according to the EU harmonised methodology. This is still comparatively low, but the rate will continue to rise sharply throughout the rest of this year.

With all this contraction going on, deflation must surely be looming for Bulgaria, but given the very high levels which inflation hit in the second half of last year, the annual rate of inflation continues in positive territory, and what we are seeing for the time being is (not so rapid) disinflation. Bulgaria's annual inflation rate only fell to 3.9 percent in June from 3.9 percent in May. This is the lowest level since July 2005, and there is surely much more to come, even if the pace of disinflation raises issues about the ability to maintain the currency peg.

More evidence of the deflationary pressures which are now about to arrive can be found in Bulgarian producer prices, which slumped the most in more than a decade in May, led by falling manufacturing, mining and quarrying costs. Factory-gate prices dropped 3.2 percent on an annual basis after a 2.3 percent decline in April. Producer prices rose 0.3 percent in the month, after April’s 0.8 percent decline.

Mining and quarrying producer prices slumped 13.4 percent in the year, reflecting a global decline in commodity prices, after a 15.7 percent drop in April. Metal producer prices plummeted 30.9 percent in year, after a 29 percent decline in the previous month.

Another Candidate For Internal Devaluation?

Many supporters of the continuty of the current Currency Board Arrangement aregue that while the adjustment process is likely to be a bumpy one the CBA should be able to ride out the storm. I severely doubt this, for many of the reasons I have already offered in the case of the Baltic Countries (here, here, here, and here). Advocates for maintaining the peg argue the CBA is solidly based and able to weather adverse shocks, given the substantial buffers accumulated in the fiscal reserve account (around 15.0% of GDP) and the existence of large foreign reserves. Bulgaria’s "safety margin" - the sum of international reserves and the domestic currency component of the government’s fiscal reserve account — is estimated to be around 48% of GDP. This compares favourably with the rating agencies’ estimate of contingent liabilities from the financial sector under a reasonable worst case of around 30% of GDP (Standard and Poor’s, 2009). Also, as in the Baltics there is strong feeling of national identification with the CBA, which, coupled with the solid backing of all potential stakeholders (the EU and the IMF in particular), could be consided to offer a robust anchor to the CBA. But as with the Baltics, this kind of support may not be sufficient. Lets have a look at why not.

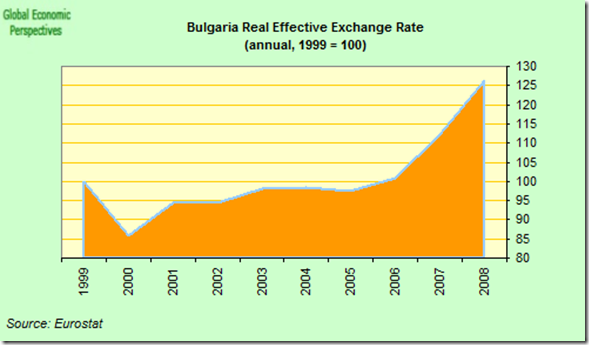

The first and most obvious issue is the competitiveness one. Since Bulgaria's domestic construction, borrowing and spending bubble has now most definitely burst, and since government spending will be brought under a tight lease by the IMF (when they inevitably arrive) Bulgaria is now (like the Baltics) destined to live by exports (not only live, but also pay down some of the accumulated debt) and this is just where we hit a snag. If we look at the chart for Bulgaria's Real Effective Exchange Rate, then we will see that the country has experienced a significant drop in international competitiveness since the end of 2005, due largely to the high level of inflation the country has suffered.

Wage costs have risen significantly, and even as recently as the first quarter of this year total hourly labour cost rose by an annual 19.2%. The total hourly labour cost was up by 18.5% in industry, by 16.3% in services and by 32.2% in construction according to the statistics office.

Basically then, in order to maintain the CBA Bulgaria will need what is called an "internal devaluation" (generalised reduction in prices and wages) of something like 20%, and seeing the pace at which this process has progressed in the Baltics, there are serious questions about whether Bulgaria would be able to implement such an internal devaluation (ecen with IMF support) before it gets caught in a vicious and painful spiral of falling GDP, falling tax income, falling government spending and even more rapidly falling GDP. Also, unlike the case of the Baltics, where the other Scandinavian countries have been able to render assistance to some extent, there is no obvious external supporter for the Bulgarian peg, and indeed the banking system in some of the countries involved in Bulgaria (Greece in particular) may be nothing like as strong or willing to maintain funding as their Swedish counterparts.

Nonetheless the Bulgarian central bank rejects devaluation, saying the country’s reserves of $16 billion is sufficient to protect the peg, and favours an “internal devaluation” byforcing down domestic wages and prices, a process which will weaken domestic demand, trigger deflation and prolong recession in my view.

Further, since there is no realistic prospect of Bulgarian euro membership in the short term, sticking to the peg for the sole purpose of quickly adopting the euro is a non sequitur, and there is no obvious exit strategy in sight.

On the other hand, while a devaluation would obviously close the current account gap far less painfully, it would not help improve Bulgaria's external financing picture owing to adverse balance sheet effects and the likely rise in bankruptcies. But as has been amply discussed in the Baltic case, the difference with an internal devaluation does not exist from this point of view, and indeed the internal devaluation path may be even more damaging given that even those with loans in Lev would be affected.

The current account will adjust in either case, since it has to, as financing is no longer viable, but this can either be done more painfully, or less painfully, and this is the real question. On the face of it Bulgaria’s incoming government, led by Sofia Mayor Boiko Borissov, advocates taking a loan from the IMF and the World Bank, and following in the footsteps of Latvia, Romania, Hungary, Serbia and Ukraine. The outgoing Socialist government ruled out any international loans. Negotiations are expected to start shortly after the new Cabinet takes office, with the loan itself would probably coming at the end of this year or during the first quarter of 2010, according to Bisser Boev, an economist in the election winning GERB party, in an interview last week.

Neil Shearing, an emerging Europe economist at Capital Economics, goes further, and says Bulgaria’s next government faces a deepening recession and an “imminent” loan agreement with the International Monetary Fund. Basically I agree with Neil: the loan will come sooner rather than later, since having the "bad cop" of the IMF to wave is the only way the new government will be able to govern and implement the internal devaluation, which it is likely will be attempted for a time, even if a breaking of the peg is the most probable medium term outcome.

Neil Shearing also forecasts Bulgaria’s economy will contract by 5 percent this year and 4 percent in 2010. My own feeling is that Neil is a bit to cautious here, and looking at the Q1 contraction and the pace of the decline since, we may well be in for a double figure (10 percent plus) 2009 contraction. Evidence from the Baltics would also tend to confirm this view: struggling to maintain a currency peg in this environment can be very costly in terms of lost GDP, since almost all the burden of current account correction falls on reducing imports, with exports falling rather than rising due to short term competitivity issues, especially when a number of other countries - Poland, Romania, the Czech Republic and Hungary may either devalue or see their currencies fall through sell-offs if they try to lower the currently punitive interest rate firewall (Hungary and Romania).

The markets also appear to be far from convinced, and credit-default swaps linked to Bulgarian five-year bonds are up in the region of 400 basis points from the one year low of 290.4 hit on May 20, as perceptions of credit quality deteriorate.

The coalition must work immediately to shore up revenue, which may fall as much as 3 billion lev ($2.1 billion) this year, said Boev, who was part of the team that mapped GERB’s economic policies and has been suggested by daily Dnevnik as the top candidate to run the Economy Ministry. “We’ll urgently revise the budget and cut what we can, postpone or freeze spending where we can,” said Boev. “This is our first task.” Bulgaria can only afford to co-finance infrastructure projects to bring roads and railways to EU requirements, Boev said. Restoring access to EU funds, which were frozen in 2008 over suspicions of graft, is crucial, he said. Bulgaria stands to receive 11 billion euros ($15.3 billion) in EU subsidies by 2013 to bring living standards closer to EU levels. Boev said the government would be “prepared” to cut investment spending and administrative costs, though it will leave social spending alone because reductions would generate additional unemployment.

The IMF forecast a budget deficit of 1 percent of gross domestic product this year and urged the previous government to cut spending by 20 percent. Ousted Prime Minister Sergei Stanishev froze public sector wages less than a month before the elections.

The Risk Of Spillovers

"The macro-situation in Bulgaria is dire," said Lars Christensen, emerging markets chief at Danske Bank.Foreign investment has plummeted. The downturn in the economy accelerated in May and June. While the new government is an improvement, I would not rule out a drop in GDP of 15 to 20pc from peak to trough," he said. My concern is that this is going to spill over into other countries. If you look at the main lenders, they are Greece, Hungary (OTP bank), and Italy."

The danger of a messy ending in Bulgaria adds another twist to the contagion worries which is facing Eastern and Southern Europe in the wake of the global crisis. A break in the Latvian peg (now, not in six months time) would be a blow, but it would, in my opinion, be containable. Estonia and Lithuania would have to correct in line, and pressure would come on Hungary and Romania, but if the Bulgarian peg goes, not in a managed devaluation but as part of a financial crisis inspired rout, which associated political chaos then the problems could rapidly escalate, immediately to four other countries in the west Balkans (Serbia, Croatia, Macedonia and Albania) and more indirectly down into an already weakend Southern Europe via the Greek and Italian banking systems.

But, you might ask, aren’t the Balkan economies too small to be a potential problem for Europe? This is true, but we need to bear in mind that all four of these nations, despite being outside the European Union, are in fact effectively euroised economies - in all cases their currencies are pegged to the euro. In addition all the Balkan countries have very close economic ties with southern Europe via the channel of expatriate remittances. And the economic problems which currently exist in Greece and Italy only serve to further weaken the nations of the Western Balkans, due to the strong trade linkages that exist within the region. These impacts will in their turn work their way back negatively into Greece and Italy due to their role in funding the region. South Eastern Europe could therefore, be quite literally at risk of economic seize-up.

And we should never forget that the political consequences of economic and currency reversals in the Western Balkans are potentially far greater than the Baltics simply because the former region has a population three times greater than that of the latter.

To be precise, maintaining Balkan GDP involves significant currency corrections. These corrections can take place by formal devaluations, or via the so-called "internal devaluation" process. The slower the Balkan currencies correct, the greater the depth and length of the recession. Basically, under these circumstances, I think that the incentive to devalue will, in the end, be too great. The immediate impact of such devlaluations will be most painful for countries like Croatia, which has a large proportion of euro-denominated loans.

When it comes to the short term dynamics of the looming currency crisis in Emerging Europe, one of the Baltic Three, probably Latvia, will be first to concede its peg. When it does others are almost bound to follow. Everything depends on whether the EU Commission and the IMF are proactive or limit themselves to a mere reactive, problem containment role. If the Latvian currency realignment is done in an organised and systematic fashion, then it may, even at this late date, be a containable process. If the situation is left to fester, and the country falls into the grip of a growing political anarchy, then containment will be much more difficult, since panic will more than likely set in.

A similar situation pertains in Bulgaria. Absent a Latvian devaluation, it is not unthinkable that the Lev peg may be maintained for another year or so. But if the authorities do go down this road, then we face the severe risk of a raggedy ending, since the problem is not one of sustaining the peg, but of restoring competitiveness and economic growth, and this is much more difficult without a formal devaluation. And if Bulgaria does go hurtling off that cliff on which it is currently perched, then just be damn careful it doesn't drag half of South Eastern Europe careering after it.

Няма коментари:

Публикуване на коментар